Creating a Household Budget

For some people, budgeting is a bad word. It's something that tells you what you can't do anymore.

For these people, the thought of setting up a budget means that their ability to enjoy life will be over. However, for those of us who have embraced budgeting, we know that this is entirely untrue.

In fact, if properly implemented and maintained, a budget is something that can help you preserve your current lifestyle.

So, why are some people reluctant to use a budget?

For some, it's the feeling that they will no longer have control over their money, and it will inhibit their lifestyle.

For others, it's because they don't see the need for a budget because they don't have "financial problems". But, for others, it's simply because they don't know how to do it properly.

The way you budget isn't quite as important as the fact that you're doing it. Whether you choose to budget online or on paper, there are several steps to creating a budget that works for you. Fundamentally, a budget is simple, and the best way to get started is to use a budgeting worksheet. Now, let's get started!

Step 1: Estimate Your Monthly Take-Home Income

The very first step in creating a budget is to estimate your monthly take-home income, which is your net income, or the actual amount of your check after taxes and other deductions.

This is the easy part, although it can get a bit tricky when considering overtime or fluctuating hours. We never recommend counting on overtime when determining your monthly income, although we realize that this can be a major source of income.

Use your best judgment. If you're sure that overtime is constant and it won't be reduced soon, go ahead, and count it. But if overtime is only given out "as needed", or if the amount of overtime you get fluctuates, it's best to stick with your base pay.

If you can establish a budget and pay your bills without the use of overtime, you'll be ahead of the game. These funds can be used to establish a rainy-day fund, or to save for larger purchases or retirement.

There may be other sources of household income too, in addition to your wages. Be sure to include all sources, including income from your spouse, child support, social security, etc.

Add up all sources to get your total monthly net income. Now you know what you must work with and it's time to figure out your expenses.

Step 2: Estimate Your Monthly Expenses; Create a Journal

Estimating your expenses can be a bit tricky. You really must keep an open mind and try to list everything that you spend money on.

Let's face it, our lives are hectic, and we can easily lose sight of all the "little extras" that we purchase throughout the week/month/year. The best way to list your expenses as accurately as possible is to create a weekly journal or create a monthly journal.

By taking the time to jot down everything you purchase, you'll quickly see where your money is going, and you'll have a truly accurate snapshot of your total expenses.

You'll know exactly how much money you spend every month on your living expenses, as well as your "comfort items." However, be prepared for some rude awakenings during your journalizing experience. Most people simply don't realize just how much money they spend on coffee, for example.

However, after journalizing this expense, they see that they are spending $2 every day for a large coffee. At the end of the month, they now see that they've spent over $50 just for coffee that they could have easily made at home for about $7!

Now you should be starting to see the value of journalizing.

If you can save $50 just on one line item, image what you could save if you really took journalizing to heart.

Now it's time to take note of your general living expenses.

These expenses include:

Home

- First mortgage

- Second and other mortgages

- Rent

- Home or renter's insurance

- Property taxes

- Condominium fees

- Lawn care

- Security system

- Other home expenses

Utilities

- Electric

- Gas/propane

- Oil

- Water/sewer

- Garbage/trash removal

- Home phone

- Cell phone

- Cable/satellite TV

- Internet or bundled entertainment service

- Other utility services

Auto

- Auto loan or lease payment

- Auto insurance

- Gas

- Maintenance

- Public transportation/taxi services

- Parking/tolls

- Auto inspection

- Registration fees

- Excise tax

- Other auto expenses

Living

- Groceries

- Lunches/snacks at work

- Restaurants/take-out

- Clothing

- Laundry/dry cleaning

- Religious/charitable donations

- Movies/concerts/sporting events

- Video rentals/online movie services

- Pet care

- Hobbies/habits

- Haircuts/Beauty

- Birthdays/gifts

- Vacations

- Other living expenses

Childcare

- Day care

- Child support

- Tuition expenses

- Babysitter

- Activities

- Sports

- Allowances

- Other childcare expenses

Medical and Insurance

- Health insurance

- Life insurance

- Other insurance

- Doctor bills

- Dentist/dental insurance

- Prescription medications

- Other medical expenses

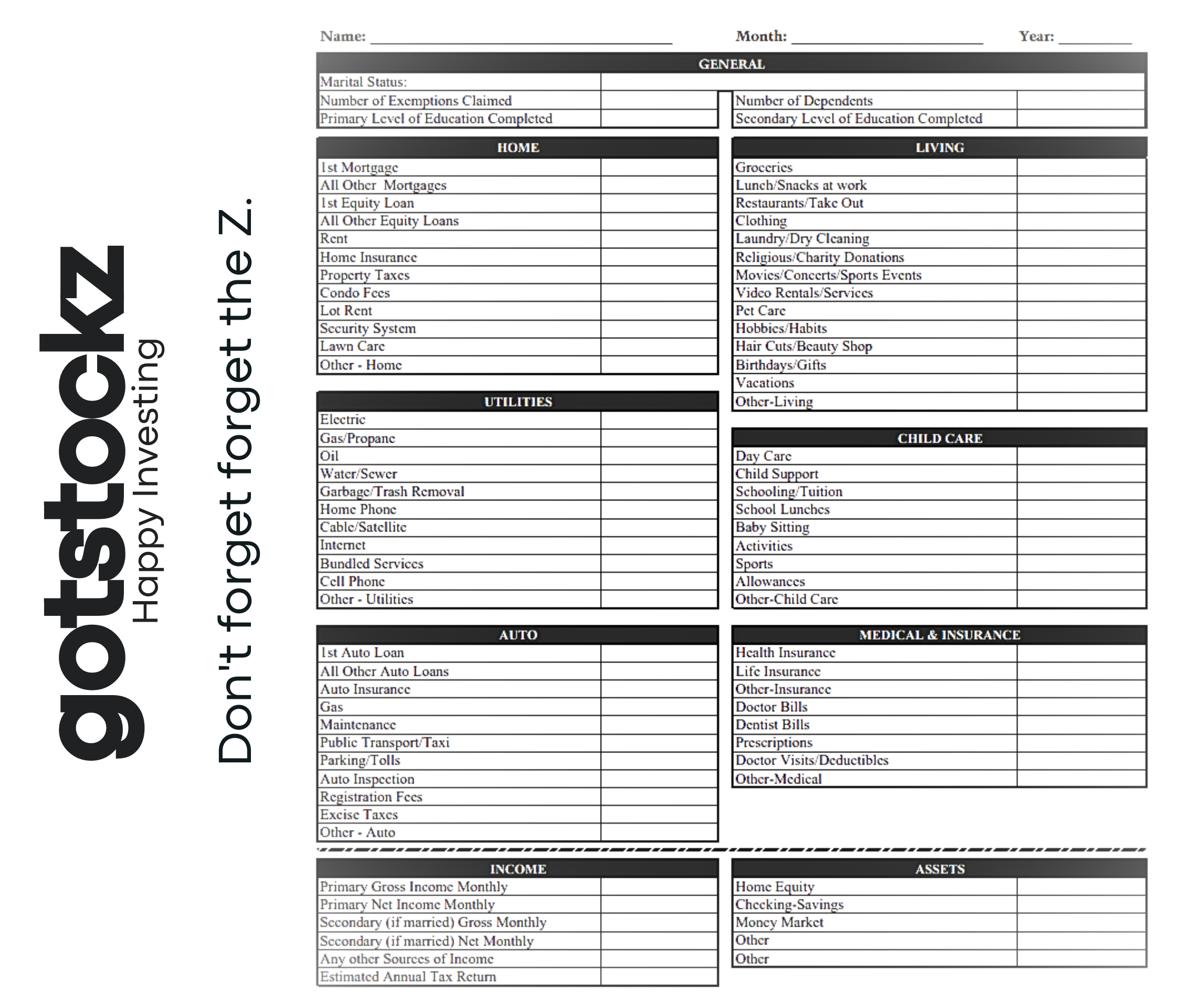

Sample Budgeting worksheet